SECURITIES AND EXCHANGE COMMISSION

ProxyProxy Statement Pursuant to Section 14(a) of theSecurities Exchange Act of 1934

(Amendment No. )Filed by the Registrant þ Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

| | | | | | |

| Filed by the Registrant | þ | | Filed by a Party other than the Registrant | | o |

| | | | | | |

| Check the appropriate box: | | | | | |

| o | Preliminary Proxy Statement |

| |

¨ | | | |

| | | | | | |

| o | Confidential, for Use of the Commission Onlyonly (as permitted by Rule 14a-6(e)(2)) | | |

| | | | | | |

| þ | | Definitive Proxy Statement |

| | | |

¨ | | | | | | |

| o | Definitive Additional Materials |

| | | |

¨ | | | | | | |

| o | Soliciting Material Pursuant to §240.14a-12 | | | | |

ASPEN INSURANCE HOLDINGS LIMITED

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)Payment of Filing Fee (Check the appropriate box):

|

| | | |

| Payment of Filing Fee (Check the appropriate box): | |

| | | |

| þ | | No fee required. |

| |

¨ | | | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | |

| | (1) | | Title of each class of securities to which transaction applies: | |

| | | |

| | (2) | | Aggregate number of securities to which transaction applies: | |

| | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| | | |

| | (4) | | Proposed maximum aggregate value of transaction: | |

| | | |

| | (5) | | Total fee paid: | |

| | | |

|

| | |

| | | | |

| |

¨ | o | Fee paid previously with preliminary materials.materials | |

| | | |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | | |

| | (1) | | Amount Previously Paid: | |

| | | |

| | (2) | | Form, Schedule or Registration Statement No.:

| |

| | | |

| | (3) | | Filing Party: | |

| | | |

| | (4) | | Date Filed: | |

| | | |

ASPEN INSURANCE HOLDINGS LIMITED

Notice of

20132016 Annual General Meeting of Shareholders

And

and

ASPEN INSURANCE HOLDINGS LIMITED

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

SHAREHOLDER MEETING TO BE HELD ON APRIL 24, 201321, 2016 The annual general meeting of shareholders

(the “Shareholders”) of Aspen Insurance Holdings Limited (the “Company” or “Aspen Holdings”) will be held at the offices of the Company, 141 Front Street, Hamilton HM19, Bermuda on April

24, 201321, 2016 at 12.00 p.m. Local Time (the “Annual General Meeting”).

The matters intended to be acted upon at the Annual General Meeting are as follows:

| |

| 1. | To re-elect Messrs. Richard Bucknall, Peter O’FlinnRonald Pressman and Ronald PressmanGordon Ireland and to elect Mr. Karl Mayr as Class III directors of the Company and elect Mr. Gordon Ireland as a Class III director of the Company; |

| |

| 2. | To provide a non-binding, advisory vote onapproving the compensation of the Company’s named executive compensationofficers set forth in the proxy statement (“Say-On-Pay Vote”); |

| 3. | To provide a non-binding, advisory vote on the frequency of future Say-On-Pay Votes (“Say-On-Frequency Vote”); |

| 4.3. | To approve the 2013 ShareCompany’s 2016 Stock Incentive Plan;Plan for Non-Employee Directors; |

| 5. |

| 4. | To re-appoint KPMG Audit plc,LLP (“KPMG”), London, England, to act as the Company’s independent registered public accounting firm and auditor for the fiscal year ending December 31, 20132016 and to authorize the Board of Directors of the Company (the “Board”) through the Audit Committee to set the remuneration for the independent registered public accounting firm;KPMG; and |

| 6. |

| 5. | To consider such other business as may properly come before the Annual General Meeting or any adjournments thereof. |

The Company will also lay before the meeting the audited financial statements of the Company for the year ended December 31,

20122015 pursuant to the provisions of the Bermuda Companies Act 1981, as amended, and the Company’s Bye-Laws.

The close of business on February

25, 201322, 2016 has been fixed as the record date for determining the

Shareholdersshareholders entitled to notice of and to vote at the Annual General Meeting or any adjournments thereof. For a period of at least

10ten (10) days prior to the Annual General Meeting, a list of

Shareholdersshareholders entitled to vote at the Annual General Meeting will be open for examination by any

Shareholdershareholder during ordinary business hours at the

offices of the CompanyCompany’s office located at 141 Front Street, Hamilton HM19, Bermuda.

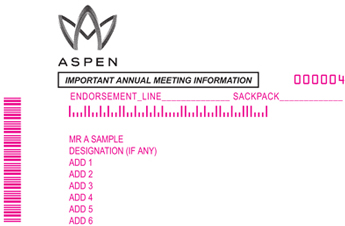

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

SHAREHOLDER MEETING TO BE HELD ON APRIL 24, 201321, 2016 The Proxy Statement, the Notice of Internet Availability of Proxy Materials and the Annual Report on

Form 10-K for the year ended December 31, 20122015 are available athttp://www.edocumentview.com/AHL and http://www.aspen.co. The Company has taken advantage of the

U.S. Securities and Exchange Commission rule allowing companies to furnish proxy materials via the

internet.Internet. On or about March

13, 2013,10, 2016, the Company will mail a Notice of Internet Availability of Proxy Materials (“Notice”) to all

Shareholdersshareholders as of the record date, February

25, 2013.22, 2016. The Notice will contain instructions on how to gain access to the Company’s Proxy Statement and

2012 Annual Report on Form

10-K.10-K for the fiscal year ended December 31, 2015. In addition, the Notice will contain instructions to allow

youshareholders to request copies of the proxy materials

to be sent to you by mail. The proxy materials sent by mail will include a proxy card containing instructions to

castsubmit your

voteproxy via the

internetInternet or telephone, or alternatively you may complete, sign and return the proxy card by mail.

If you are unable to be present

at the Annual General Meeting personally, please follow the instructions for

votingsubmitting your proxy on the Notice you received for the meeting or, if you requested a paper copy of our proxy materials, by completing, signing, dating and returning your proxy card, or by

internetInternet or telephone as described

in the Proxy Statement.on your proxy card.

By Order of the Board of Directors,

Patricia Roufca

Michael Cain

ASPEN INSURANCE HOLDINGS LIMITED

ANNUAL GENERAL MEETING OF SHAREHOLDERS

to be held on April 24, 201321, 2016 The

proxy statementProxy Statement, the Notice of Internet Availability of Proxy Materials and

annual report to security holdersthe Annual Report on Form 10-K for the year ended December 31, 2015 are available at

http://www.edocumentview.com/AHL andhttp://www.aspen.co This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies on behalf of the Board of Directors (the “Board”) of Aspen Insurance Holdings Limited (the “Company”“Company,” “we,” “us” or “our”) to be voted at our annual general meeting of shareholders (the “Shareholders”) to be held at the offices of the Company located at 141 Front Street, Hamilton HM19, Bermuda on April 24, 201321, 2016 at 12:00 p.m. local time, or at such other meeting upon any postponement or adjournment thereof (the “Annual General Meeting”). Directions to the meetingAnnual General Meeting may be obtained by contacting the Company at 1-441-295-8201.1 (441) 295-8201. This Proxy Statement, the Notice of Annual General MeetingInternet Availability of ShareholdersProxy Materials and the accompanying form of proxy are being first mailed to Shareholdersshareholders on or about March 13, 2013.10, 2016. These proxy materials, along with a copy of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012,2015, are also available for viewing athttp://www.edocumentview.com/AHL andhttp://www.aspen.co. Shareholders will be asked to take the following actions at the Annual General Meeting:

| |

| 1. | To vote FOR the re-election of Messrs. Ronald Pressman and Gordon Ireland and the election of Mr. Karl Mayr as Class III directors of the Company; |

| |

| 2. | To vote FOR the approval of compensation of the Company’s named executive officers as set forth in this Proxy Statement, as part of the non-binding, advisory say-on-pay vote (“Say-On-Pay Vote”); |

| |

| 3. | To vote FOR the adoption of the Company’s 2016 Stock Incentive Plan for Non-Employee Directors; and |

| |

| 4. | To vote FOR the re-appointment of KPMG LLP (“KPMG”), London, England, to act as the Company’s independent registered public accounting firm and auditor for the fiscal year ending December 31, 2016 and to authorize the Board through the Audit Committee (the “Audit Committee”) to set the remuneration for KPMG. |

Shareholders may be asked to consider such other business as may properly come before the Annual General Meeting or any adjournments thereof.

Proposals 1, 2, 3 and 4 each require an affirmative vote of the majority of the voting power of the votes cast and entitled to vote at the Annual General Meeting (taking into account the Company’s Bye-Laws 63 to 67). The Company intends to conduct all voting at the Annual General Meeting by poll as requested by the Chairman of the Annual General Meeting, in accordance with our Bye-Laws.

As of February

25, 2013,22, 2016, the record date for the determination of persons entitled to receive notice of, and to vote at, the Annual General Meeting, there were

69,786,69960,762,721 ordinary shares of the Company, par value U.S.

0.15144558¢0.15144558 cents per share (the “ordinary shares”), issued and outstanding. The ordinary shares are our only class of equity securities outstanding currently entitled to vote at the Annual General Meeting.

Holders of ordinary shares are entitled on a poll to one vote for each ordinary share held on each matter to be voted upon by the Shareholdersshareholders at the Annual General Meeting.

The presence of one or more shareholders in person or by proxy holding at least 50% of the voting power (that is, the number of maximum possible votes of the shareholders entitled to attend and vote at a general meeting, after giving effect to the provision of our Bye-Laws 63 to 67) of all of the issued ordinary shares of the Company throughout the Annual General Meeting shall form a quorum for the transaction of business at the Annual General Meeting. Only recordholders or their properly appointed proxies, beneficial owners of the Company’s ordinary shares who have evidence of such ownership and provide personal identification (such as a driver’s license or passport) and the Company’s guests may attend the Annual General Meeting.

Pursuant to our Bye-Laws 63 to 67, the voting power of all ordinary shares is adjusted to the extent necessary so that there is no 9.5% U.S. Shareholder. For the purposes of our Bye-Laws, a 9.5%“9.5% U.S. ShareholderShareholder” is defined as a United States Person (as defined in the Internal Revenue Code of 1986, as amended, of the United States (the “Code”)) whose “controlled shares” (as defined below)

constitute

nine and one-half percent9.5% or more of the voting power of all ordinary shares and who would be generally required to recognize income with respect to the Company under Section 951(a)(1) of the Code, if the Company were a controlled foreign corporation as defined in Section 957 of the Code and if the ownership threshold under Section 951(b) of the Code were 9.5%.

Because the

The applicability of the voting power reduction provisions to any particular

Shareholdershareholder depends on facts and circumstances that may be known only to the

Shareholdershareholder or related

persons,persons. Accordingly, the Company requests that any holder of ordinary shares with reason to believe that it is a 9.5% U.S. Shareholder (as described above) contact the Company promptly so that the Company may determine whether the voting power of such holder’s ordinary shares should be reduced. By submitting a proxy, unless the Company has otherwise been notified or made a determination with respect to a holder of ordinary shares, a holder of ordinary shares will be deemed to have confirmed that, to its knowledge, it is not, and is not acting on behalf of, a 9.5% U.S. Shareholder.

In order to determine the number of controlled shares owned by each

Shareholder,shareholder, we are authorized to require any

Shareholdershareholder to provide such information as the Board may deem necessary for the purpose of determining whether any

Shareholder’sshareholder’s voting rights are to be adjusted pursuant to the Company’s Bye-Laws. We may, in our reasonable discretion, disregard the votes attached to ordinary shares of any

Shareholdershareholder failing

3

to respond to such a request or submitting incomplete or inaccurate information. “Controlled shares” will include, among other things, all ordinary shares that a person is deemed to beneficially own directly, indirectly or constructively (as determined pursuant to Sections 957 and 958 of the Code).

The presence of one or more Shareholders in person or by proxy holding at least 50% of the voting power (that is, the number of maximum possible votes of the Shareholders entitled to attend and vote at a general meeting, after giving effect to the provision of our Bye-Laws 63 to 67) of all of the issued and outstanding ordinary shares of the Company throughout the meeting shall form a quorum for the transaction of business at the Annual General Meeting.

Pursuant to our Bye-Laws 63 to 67, it is currently expected that there will be no adjustments to the voting power of any of the Company’s

Shareholders.shareholders. Therefore, every

Shareholdershareholder will be entitled

on a poll to one vote for each ordinary share held by such

Shareholdershareholder on each matter to be voted upon.

The Company’s Bye-Law 84 provides that if the voting rights of any shares of the Company are adjusted pursuant to Bye-Laws 63 to 67 and the Company is required or entitled to vote at a general meeting of any of its subsidiaries organized under the laws of a jurisdiction outside of the United States of America (each, a “Non-U.S. Subsidiary”), the Board shall refer the subject matter of the vote to

Shareholdersshareholders of the Company on a poll and seek authority from the

Shareholdersshareholders in a general meeting of the Company for the Company’s corporate representative or proxy to vote in favor of the resolutions proposed by such Non-U.S. Subsidiary pro rata to the votes received at the general meeting of the Company’s corporate representative or proxy to vote against the directing resolution being taken, respectively, as an instruction for the Company’s corporate representative or proxy to vote in the appropriate proportion of its shares for, and the appropriate proportion of its shares against, the resolution proposed by the Non-U.S. Subsidiary.

At the Company’s 2009 annual general meeting,

of Shareholders, the Company’s Shareholdersshareholders approved resolutions amending the constitutional documents of the Company and its Non-U.S. Subsidiaries to modify each of their respective voting push-up provisions (which mirror those of the Company described in the preceding paragraph) found in such constitutional documents, so that such provision is only applicable in the event that the voting rights of any shares of the Company are adjusted pursuant to the Company’s Bye-Laws 63-67. If voting rights are not adjusted pursuant to the above, resolutions proposed by the Company’s Non-U.S. Subsidiaries will not be voted upon by the Company’s

Shareholdersshareholders at the Annual General Meeting.

At the Annual General Meeting, Shareholders will be asked to take the following actions:

| 1. | To vote FOR the re-election of Messrs. Richard Bucknall, Peter O’Flinn and Ronald Pressman as Class III directors of the Company and the election of Mr. Gordon Ireland as a Class III director of the Company. |

| 2. | To vote FOR the approval of compensation of the Company’s named executive officers, as disclosed in this Proxy Statement as part of the non-binding advisory vote for Say-On-Pay. |

| 3. | To vote to hold an advisory, non-binding vote on executive compensation every 1 YEAR. |

| 4. | To vote FOR the adoption of the 2013 Share Incentive Plan. |

| 5. | To vote FOR the appointment of KPMG Audit plc (“KPMG”), London, England, to act as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013 and to authorize the Board through the Audit Committee (the “Audit Committee”) to set the remuneration for the independent registered public accounting firm. |

At the Annual General Meeting, Shareholders may be asked to consider and take action with respect to such other matters as may properly come before the Annual General Meeting.

4

Proposals 1, 2, 4 and 5 each require an affirmative vote of the majority of the voting power of the votes cast at the Annual General Meeting and entitled to vote on that proposal (taking into account Bye-Laws 63 to 67). With respect to Proposal 3, shareholders will be deemed to have approved the alternative that receives the most votes, even if that alternative receives less than a majority of the votes cast at the Annual General Meeting. The Company intends to conduct all voting at the Annual General Meeting by poll as requested by the Chairman of the meeting, in accordance with our Bye-Laws.

PRESENTATION OF FINANCIAL STATEMENTS

In accordance with the Bermuda Companies Act 1981, as amended, and Bye-Law 139 of the Company, the Company’s audited financial statements for the year ended December 31,

20122015 were approved by the Board and will be presented at the Annual General Meeting.

The Board has approved these statements. There is no requirement under Bermuda law that these statements be approved by

Shareholders,shareholders and no such approval will be sought at the

meeting.Annual General Meeting.

SOLICITATION AND REVOCATION

PROXIES IN THE FORM ENCLOSED ARE BEING SOLICITED BY, OR ON BEHALF OF, THE BOARD. THE

BOARD HAS DESIGNATED THE PERSONS NAMED IN THE ACCOMPANYING FORM OF PROXY AS PROXIES. Such persons designated as proxies serve as officers of the Company. Any

Shareholdershareholder desiring to appoint another person to represent him or her at the Annual General Meeting may do so either by inserting such person’s name in the blank space provided on the accompanying form of proxy or by completing another form of proxy and, in either case, delivering an executed proxy to the

Company Secretary

of the Company at the address indicated on page 3

before the time of

this Proxy Statement prior to the Annual General Meeting. It is the responsibility of the

Shareholdershareholder appointing such other person to represent him or her to inform such person of this appointment.

Each ordinary share represented by a properly executed proxy which is returned and not revoked will be voted in accordance with the instructions, if any, given thereon. If no instructions are provided in a properly executed proxy, it will be voted “FOR” all nominees in Proposal 1, “FOR” Proposals 2, 4,3 and 5, and every “1 YEAR” for Proposal 3,4 and in accordance with the proxyholder’s best judgment as to any other business as may properly come before the Annual General Meeting. If a Shareholdershareholder appoints a person other than the persons named in the enclosed form of proxy to represent him or her, such person will vote the shares in respect of which he or she is appointed proxyholder in accordance with the directions of the Shareholdershareholder appointing him or her. Any Shareholdershareholder who executes a proxy may revoke it at any time before it is voted by (i) delivering to the Company Secretary of the Company a written statement revoking such proxy, by(ii) executing and

delivering a later-dated proxy or

by(iii) voting in person at the Annual General Meeting. Attendance at the Annual General Meeting by a

Shareholdershareholder who has executed and delivered a proxy to us shall not in and of itself constitute a revocation of such proxy. For ordinary shares held in “street name” by a broker, bank or other nominee, new voting instructions must be delivered to the broker, bank or nominee prior to the Annual General Meeting.

To the extent that beneficial owners do not furnish voting instructions with respect to any or all proposals submitted for shareholder action, member brokerage firms of The New York Stock Exchange, Inc. (the “NYSE”) that hold ordinary shares in street name“street name” for such beneficial owners may not vote in their discretion uponon non-routine matters, such as Proposals 1, 2 and 3, but have the discretion to vote on routine matters, such as Proposal 4. If beneficial owners do not provide voting instructions to their brokerage firm or 4. other nominee, such brokerage firm or other nominee may therefore only vote their shares on Proposal 4 and any other routine matters properly presented for a vote at the Annual General Meeting.

Any “broker non-votes” and abstentions will be counted toward the presence of a quorum at, but will not be considered votes cast on any proposal brought before, the Annual General Meeting. Generally, “broker non-votes” occur when ordinary shares held for a beneficial owner are not voted on a particular proposal because the broker has not received voting instructions from the beneficial owner and the broker does not have discretionary authority to vote the ordinary shares on a particular proposal. If a quorum is not present, the Annual General Meeting shall stand adjourned to such other day and such other time and place as the chairman of the meeting may determine and at such adjourned meeting two

Shareholders(2) shareholders present in person or by proxy and holding at least ten percent (10%) in

the aggregate of the voting power of shares entitled to vote at such meeting (taking into account the

provisions ofCompany’s Bye-Laws 63-67) shall be a quorum. The Company shall give not less than twenty-one (21) days’ notice of any meeting adjourned through want of a quorum and such notice shall state that

5

two Shareholders(2) shareholders present in person or by proxy and holding at least ten percent (10%) in the aggregate of the voting power of shares entitled to vote at such meeting (taking into account the provisions ofCompany’s Bye-Laws 63-67) shall be a quorum. An adjournment will have no effect on the business that may be conducted at the adjourned meeting.

We will bear the cost of solicitation of proxies. We have engaged Innisfree

M&A Incorporated to be our proxy solicitation agent. For these services, we will pay Innisfree

M&A Incorporated a fee of approximately $15,000 plus reasonable expenses. Further solicitation may be made by our directors, officers and employees personally, by telephone, Internet or otherwise, but such persons will not be specifically compensated for such services. We may also make, through bankers, brokers or other persons, a solicitation of proxies of beneficial holders of the ordinary shares. Upon request, we will reimburse brokers, dealers, banks or similar entities acting as nominees for reasonable expenses incurred in forwarding copies of the proxy materials relating to the Annual General Meeting to the beneficial owners of ordinary shares which such persons hold of record.

6

Board of Directors of the Company

Pursuant to provisions that were in our Bye-Laws and a shareholders’ agreement by and among us and certain shareholders prior to our initial public offering in 2003, certain of our shareholders had the right to appoint or nominate and remove directors to serve on the Board. Mr. Cormack was appointed director by Candover, one of our founding shareholders. After our initial public offering, no specific shareholder has the right to appoint or nominate or remove one or more directors pursuant to an explicit provision in our Bye-Laws or otherwise.

Our Bye-Laws provide for a classified Board divided into three classes of directors with each class elected to serve a term of three years. Our incumbent Class I

Directorsdirectors were elected at our

20112014 annual general meeting and are scheduled to serve until our

20142017 annual general meeting. Our incumbent Class II

Directorsdirectors were elected at our

20122015 annual general meeting and are scheduled to serve until our

20152018 annual general meeting. Our incumbent Class III

Directorsdirectors were elected at our

20102013 annual general meeting and will be subject for

re-election(re)election at

this 2013the Annual General

Meeting (with the exception of Ronald Pressman who was appointed by the Board with effect from November 17, 2011 and elected as a Class III Director at our 2012 annual general meeting, and Gordon Ireland who was appointed by the Board with effect from February 7, 2013).Meeting.

We have provided information below about our directors, including their ages, committee positions, business experience for the past five years and the names of other companies on which they serve, or have served,

as director for the past five years. We have also provided information regarding each director’s specific experience, qualifications, attributes and skills that led the Board to conclude that each should serve as a director.

As of February 15, 2013,2016, we had the following directors on the Board and committees: | | | | | | | | | | | | | | | | | | |

Name | | Age | | | Director

Since | | | Audit | | Compensation | | Corporate

Governance

& Nominating | | Investment | | Risk |

Class I Directors: | | | | | | | | | | | | | | | | | | |

Christopher O’Kane | | | 58 | | | | 2002 | | | | | | | | | | | |

Heidi Hutter | | | 55 | | | | 2002 | | | ü | | | | ü | | | | Chair |

John Cavoores | | | 55 | | | | 2006 | | | | | | | | | | | ü |

Liaquat Ahamed | | | 60 | | | | 2007 | | | | | | | | | Chair | | ü |

Albert Beer | | | 62 | | | | 2011 | | | ü | | ü | | | | | | ü |

Class II Directors: | | | | | | | | | | | | | | | | | | |

Julian Cusack | | | 62 | | | | 2002 | | | | | | | | | ü | | ü |

Glyn Jones | | | 60 | | | | 2006 | | | | | | | | | ü | | |

Class III Directors: | | | | | | | | | | | | | | | | | | |

Ian Cormack | | | 65 | | | | 2003 | | | Chair | | ü | | | | | | ü |

Richard Bucknall | | | 64 | | | | 2007 | | | ü | | Chair | | ü | | | | |

Peter O’Flinn | | | 60 | | | | 2009 | | | ü | | | | Chair | | | | |

Ronald Pressman | | | 54 | | | | 2011 | | | | | ü | | | | ü | | |

Gordon Ireland(1) | | | 59 | | | | 2013 | | | ü | | | | | | | | |

|

| | | | | | | | | | | | | | |

| Name | | Age | | Director Since | | Audit | | Compensation | | Corporate

Governance & Nominating | | Investment | | Risk |

| Class I Directors: | | | | | | | | | | | | | | |

| Christopher O’Kane | | 61 | | 2002 | | | | | | | | | | |

Heidi Hutter (1) | | 58 | | 2002 | | P | | | | P | | | | Chair |

| John Cavoores | | 58 | | 2006 | | | | | | | | | | P |

| Liaquat Ahamed | | 63 | | 2007 | | | | | | | | Chair | | P |

| Albert Beer | | 65 | | 2011 | | P | | | | | | | | P |

| Class II Directors: | | | | | | | | | | | | | | |

| Glyn Jones | | 63 | | 2006 | | | | | | | | P | | |

| Gary Gregg | | 60 | | 2013 | | P | | P | | | | | | P |

| Bret Pearlman | | 49 | | 2013 | | | | P | | | | P | | |

| Class III Directors: | | | | | | | | | | | | | | |

| Richard Bucknall | | 67 | | 2007 | | P | |

| | P | | | | P |

| Peter O’Flinn | | 63 | | 2009 | | P | | | | Chair | | | | |

| Ronald Pressman | | 57 | | 2011 | | | | Chair | | | | P | | |

| Gordon Ireland | | 62 | | 2013 | | Chair | | | | | | | | P |

| Karl Mayr | | 65 | | 2015 | | | | | | | | | | P |

_________

| |

| (1) | Effective February 7, 2013.October 29, 2014, Ms. Hutter also serves as the Company’s Lead Independent Director. |

Glyn Jones. With effect from May 2, 2007, Mr. Jones was appointed as Chairman.Chairman of the Board. Mr. Jones has been a director and a member of the Investment Committee since October 30, 2006. He also has served as a non-executive director and Chairman of Aspen Insurance UK Limited (“Aspen U.K.”) sincebetween December 4, 2006.2006 and May 6, 2014 and was a member of Aspen U.K.’s audit committee between September 4, 2006 and May 6, 2014. Mr. Jones is also the Senior Independent DirectorChairman of Aldermore Group plc, chair of its corporate governance and nominating committee and a member of its compensation committee. Mr. Jones is also the Chairman of Aldermore Bank plc, Aldermore Group plc’s banking subsidiary. Between September 2012 and May 2015, Mr. Jones was the senior independent director, chair of the investment committee and audit committee member of Direct Line Insurance Group.Group plc, a FTSE 100 company. He was also a director of UK Insurance Limited, a subsidiary of Direct Line, between October 2012 and May 2015. Mr. Jones was previously the Chairman of Hermes Fund Managers, BT Pension Scheme Management Ltd and Towry Holdings Limited.Holdings. Mr. Jones was most recently the Chief Executive Officer of Thames River Capital.Capital LLP from October 2005 until May 2006. From 2000 to 2004, he served as Chief Executive Officer of Gartmore Investment Management in the U.K.United Kingdom. Prior to Gartmore, Mr. Jones was Chief Executive Officer of Coutts NatWest Group and Coutts Group, which he joined in 1997, and was responsible for strategic leadership, business performance and risk7

management. In 1991, he joined Standard Chartered, later becoming the General Managergeneral manager of Global Private Banking. Mr. Jones was a consulting partner with Coopers & Lybrand/Deloitte Haskins & Sells Management Consultants from 1981 to 1990.

Mr. Jones has over 2425 years of experience within the financial services sector. He is the former Chief Executive Officerchief executive officer of a number of large, regulated, international financial services groups such as Gartmore Investment Management and Coutts Natwest Group and has served as chairman of the board in a number of other

financial services companies. As a result, Mr. Jones provides the Board leadership for a complex, global and regulated financial services business such as ours.

Christopher O’Kane. Mr. O’Kane has been our Chief Executive Officer and a director since June 21, 2002. He was also thea director of Aspen U.K. between 2002 and 2014 and its Chief Executive Officer of Aspen U.K. until January 2010 (and is still2010. He also serves as a director) and wasdirector on various other boards of the Company’s subsidiaries. Mr. O’Kane served as Chairman of Aspen Bermuda Limited (“Aspen Bermuda”) until December 2006. He is also on the Board of Aspen’s U.S. entities. Prior to the creation of Aspen Holdings,the Company, from November 2000 until June 2002, Mr. O’Kane served as a director of Wellington Underwriting plc and Chief Underwriting Officer of Lloyd’s Syndicate 2020 where he built his specialist knowledge in the fields of property insurance and reinsurance, together with active underwriting experience in a range of other insurance disciplines. From September 1998 until November 2000, Mr. O’Kane served as one of the underwriting partners for Syndicate 2020. Prior to joining Syndicate 2020, Mr. O’Kane served as deputy underwriter for Syndicate 51 from January 1993 to September 1998. Mr. O’Kane began his career as a Lloyd’s broker. Mr. O’Kane has over 30 years of experience in the specialty re/insurance industry and is both a co-founder of our

Company’sCompany's business and its founding Chief Executive Officer. Mr. O’Kane brings his market experience and industry knowledge to Board discussions and is also directly accountable to the Board for the day-to-day management of the Company and the implementation of

its business strategy.

Julian Cusack, Ph.D. Mr. Cusack resumed his role of Chief Risk Officer from November 1, 2012 until February 7, 2013. From February 29, 2012 until October 31, 2012, he assumed the role of acting Chief Financial Officer during the Company’s search process for a permanent Group Chief Financial Officer. Mr. Cusack was our Chief Risk Officer from January 14, 2010 until February 29, 2012. He was previously our Chief Operating Officer from May 1, 2008 to January 14, 2010, and has been a director since June 21, 2002. He was the Chief Executive Officer of Aspen Bermuda from its formation in 2002 until July 1, 2011 and was appointed Chairman of Aspen Bermuda in December 2006. Mr. Cusack was previously our Chief Financial Officer from June 21, 2002 to April 30, 2007. Mr. Cusack previously worked with Wellington where he was Managing Director of Wellington Underwriting Agencies Ltd. (“WUAL”) from 1992 to 1996, and in 1994 joined the Board of Directors of Wellington Underwriting Holdings Limited. He was Group Finance Director of Wellington Underwriting plc from 1996 to 2002. He was also a director of Parhelion Capital Limited, in which we had minority investment. Mr. Cusack was a director and audit committee member of Hardy Underwriting Bermuda Limited from December 2007 until July 2012.Mr. Cusack has over 28 years of experience within the re/insurance industry having held a number of senior roles previously at Wellington. Mr. Cusack, a qualified accountant, is also a co-founder of our Company. Mr. Cusack is Chairman of Aspen Bermuda and has responsibility for strategic projects. Mr. Cusack was our Chief Risk Officer until February 7, 2013 and was previously Chair of our Reserve Committee (a management committee) until January 2011. Accordingly, he provides the Board with valuable input on the Company’s risk framework, risk tolerances and risk mitigation efforts, as well as providing an insight on our reserving practices.

Liaquat Ahamed. Mr. Ahamed has been a director of the Company since October 31, 2007. Mr. Ahamed has a background in investment management with leadership roles that include heading the World Bank’s investment division. From 2004, Mr. Ahamed has been an adviser to the Rock Creek Group, an investment firm based in Washington D.C. From 2001 to 2004, Mr. Ahamed was the Chief Executive Officer of Fischer Francis Trees & Watts, Inc., a subsidiary of BNP Paribas specializing in institutional single and multi-currency fixed income investment portfolios. Mr. Ahamed ishas been a director of the Rohatyn Group and related series of funds since 2005 and a member of the Board of Trustees at the Brookings Institution and a member of the Board of Trustees of the Putnam Funds.Funds since 2012.

8

Mr. Ahamed has over

2830 years of experience in investment management and

has previously served as

a Chief Investment Officerthe chief investment officer and Chief Executive Officer of Fischer Francis Trees & Watts, Inc.

, an international fixed income business. Currently, Mr. Ahamed is a director of the Rohatyn Group and a member of the Board of Trustees of the Putnam Funds. Mr. Ahamed’s investment management experience provides the Board with experience to oversee the Company’s investment decisions, strategies and investment risk appetite. As a result,

of this, Mr. Ahamed also serves as

the Chair of the Investment

Committee and is a member of the Risk Committee.

Albert J. Beer. Mr. Beer has been a director of the Company since February 4, 2011.2011 and a director of Aspen Bermuda since July 23, 2014. Since 2006, Mr. Beer has been the Michael J Kevany/XL Professor of Insurance and Actuarial Science at St John’s University School of Risk Management. From 1992 to 2006, Mr. Beer held various senior executive positions at American Re-Insurance Corporation (Munich Re America). Previously, from 1989 to 1992, Mr. Beer held various positions at Skandia America Reinsurance Corporation, including that of Chief Actuary. He also has been a board member of United Educators Insurance Company since 2006, having served as Vice-Chair from 2009 to 2013. Since 2009, Mr. Beer has been a Trustee Emeritus for the Actuarial Foundation, having served as a board member from 2006 until 2009. In 2013, Mr. Beer was elected as a member of the Board of the American Academy of Actuaries, having previously served on such board from 1992 until 1994 and from 1996 until 1999. Mr. Beer was a member of the Actuarial Standards Board, which promulgates standards for the actuarial profession in the United States, sincefrom 2007 to 2012 and was its Chair from 2010 to 2011. He is also the Vice-Chair of United Educators Insurance Company since 2006. Mr. Beer previously served as a member of the Board of the Casualty Actuarial Society, American Academy of Actuaries and the Actuarial Foundation, where he has been a trustee emeritus since 2009.Society. Mr. Beer has over 30 years of actuarial experience in the insurance industry. Mr. Beer’s roles at American Re-Insurance Corporation included the active supervision of principal financial and accounting officers. In addition, Mr. Beer has extensive experience in reserving matters, which constitute the principal subjective assessments within the Company’s accounts. As a result, Mr. Beer

also serves as a designated financial expert on the Company’s Audit

Committee and is a member of the Risk Committee.

Richard Bucknall. Mr. Bucknall has been a director of the Company since July 25, 2007, a director of Aspen U.K. since January 14, 2008 and a director of Aspen Managing Agency Limited (“AMAL”) since February 28, 2008. Mr. Bucknall previously served as Chairman of the Compensation Committee of the Board (the “Compensation Committee”) between July 2007 and March 2015. Mr. Bucknall retired from Willis Group Holdings Limited where he was Vice Chairman from February 2004 to March 2007 and Group Chief Operating Officer from January 2001 to December 2006. While at Willis, Mr. Bucknall served as director on various Boardsboards within the Willis Group. He was also previously Chairman/Chief Executive Officer of Willis Limited from May 1999 to March 2007. Mr. Bucknall is currently the non-executive Chairman of FIM Services Limited and the non-executive Chairman of the XIS Group (Ins-Sure(comprised of Ins-Sure Holdings Limited, Ins-Sure Services Limited, London Processing Centre Ltd and LSPO Limited). On December 11, 2012 where he was appointed Chairmanis also a member of the audit committee. Mr. Bucknall is also currently a director of Tokio Marine Kiln Insurance Limited (formerly Tokio Marine Europe Insurance LimitedLimited), having previously served as chairman from December 2012 until February 2016 and as a non-executive director since 2010.2010, where he is also a member of the audit and risk committees. Effective February 2016, Mr. Bucknall was also previouslyserves as a director of Kron AS until 2009. HeTokio Marine Kiln Syndicates Limited. Mr. Bucknall is a Fellowfellow of the Chartered Insurance Institute. Mr. Bucknall has over 40 years of experience within the re/insurance broking industry and latterly served as Group Chief Operating Officer of the Willis Group. Since our revenues are primarily derived from brokers as distribution channels, Mr. Bucknall’s

background in the insurance broking industry provides the Board with an experienced perspective on broking relationships and their ability to impact our trading operations. Given his broad background across a number of operational disciplines, Mr. Bucknall

serves asis a member of the

Chair of our Compensation Committee.Audit, Risk and Corporate Governance and Nominating Committees.

John Cavoores. Mr. Cavoores has been a director of the Company since October 30, 2006. From October 5, 2010 through December 31, 2011, Mr. Cavoores was also the Co-Chief Executive Officer of Aspen Insurance, focusing on Aspen Insurance’s casualty and professional lines and U.S. property businesses. Mr. Cavooresbusinesses, where he had executive oversight for Aspen Insurance’s U.S. platform. From January 1, 2012, Mr. Cavoores re-assumedcontinued his role as a non-executive director of the Company. Mr. Cavoores was previously an advisor to Blackstone (fromFrom September 2006 until March 15, 2010).2010, Mr. Cavoores was an advisor to Blackstone. During 2006, Mr. Cavoores was a Managing Director of Century Capital, a Boston-based private equity firm. From 2003 to 2005, Mr. Cavoores previously served as President and Chief Executive Officer of OneBeacon Insurance Company, a subsidiary of the White Mountains Insurance Group, from 2003 to 2005.Group. He was employed with OneBeacon from 2001 to 2005. Among his other positions, Mr. Cavoores was President of National Union Insurance Company, a subsidiary of AIG, Inc. He spent 19 years at Chubb Insurance Group, where he served as Chief Underwriting Officer, Executive Vice President and Managing Director of overseas9

operations, based in London. Mr. Cavoores has been the Chairman of Guidewire Software, Inc. since June 2015 and a director since December 2012. Mr. Cavoores has also been a director of Cunningham Lindsey, Inc. since October 2014. Mr. Cavoores previously served as a director of Cyrus Reinsurance Holdings and Alliant Insurance Holdings. Mr. Cavoores is a current director of Guidewire Software, Inc.

Mr. Cavoores has over 30 years of experience within the insurance industry having, among other positions, formerly served as President and Chief Executive Officer of OneBeacon

Insurance, a subsidiary of White Mountains.Insurance. As a result, Mr. Cavoores provides the Board with broad ranging business experience, with particular focus on insurance matters and strategies within the United

States.States, and is a member of the Risk Committee.

Ian Cormack.Gary Gregg. Mr. CormackGregg has been a director of the Company since September 22, 2003 and has served alsoApril 24, 2013. From May 2013 to 2015, Mr. Gregg was an advisor to Ortelius Ventures LLC. From 2011 to 2013, Mr. Gregg was engaged as a non-executive directorprivate consultant on a number of Aspen U.K. since 2003.insurance and non-insurance related business purchase transactions. Prior to this, Mr. Gregg held various senior positions at Liberty Mutual Group from 1989 to 2011. From 20002005 to 2002,2011, Mr. Gregg served as President of Liberty Mutual Agency Corporation, one of Liberty Mutual Group’s four major business units. Prior to this, he was Chief Executive Officerserved as President of AIG Inc.’s insurance financial services and asset management division in Europe. From 1997 to 2000, he was Chairman of Citibank International plc and Co-HeadCommercial Markets, another of the Global Financial Institutions Clientfour major business units within Liberty Mutual Group from 1999 to 2005. Before joining Liberty Mutual Group, Mr. Gregg was a partner at Citigroup. He wasKPMG Peat Marwick LLP from 1988 to 1989, where he also Country Headheld various positions of Citicorp in the United Kingdomincreasing responsibility from 19921979 to 1996.1988. Mr. CormackGregg is alsocurrently a director of Phoenix Group Holdings Ltd (previously Pearl Group Ltd.), Phoenix Life Holdings Ltd Bloomsbury Publishing Plc, National Angels Ltd, Arria LNG Limited and Xchanging plc. Mr. Cormack is also a non-executive chairman and audit committee member of Maven Income and Growth VCT 4 plc andthe executive committee, the chairman of Entertaining Finance Ltd. Hethe finance committee, and the vice-chairman of the nominating Committee of the Board of Trustees of the Museum of Science in Boston, Massachusetts, having previously served as Chairman of CHAPS, the high value clearing system in the United Kingdom, as a member of the Boardboard of Directorsgovernors. Mr. Gregg also serves as a trustee, member of Clearstream (Luxembourg), Bank Trainingthe audit committee and Development Ltd, Klipmart Corp, Carbon Reductions Ltd, deputy chairman of Qatar Insurance Services Ltd (trading as ‘Qatarlyst’) andthe development committee at the Stimson Center. Mr. Gregg previously served as a member of Millennium Associates AG’s Global Advisory Board. He wasthe academic affairs committee and the dean’s executive council of the D’Amore School of Business at Northeastern University until 2015.

Mr. Gregg has over 25 years of experience within the insurance industry, with expertise in the U.S. property and casualty market. Mr. Gregg also

previously a non-executive director of MphasiS BFL Ltd. (India), Europe Arab Bank Ltd., Pearl Assurance, London Life Assurance, National Provident Insurance, National Provident Life and Qatar Financial Centre Authority. He washas relevant entrepreneurial experience in running insurance companies through his various positions held at Liberty Mutual Group. Given his extensive operational background, Mr. Gregg also serves as a member of the

U.K. Chancellor’s City Advisory Panel from 1993 to 1998.Mr. Cormack has over 40 years of broad ranging international experience in both the bankingAudit, Compensation and insurance sectors having held senior roles at both Citigroup and AIG Inc. Mr. Cormack also serves on the boards of a number of internationally focused companies and brings his broad ranging global experience to Board debate. Given his wide ranging experience, Mr. Cormack also serves as Chair of our Audit Committee.

Risk Committees.

Heidi Hutter. Ms. Hutter has been a director of the Company since June 21, 2002 and Lead Independent Director since October 29, 2014. She has served as a non-executive director of Aspen U.K. since June 2002. On February 28, 2008, Ms. Hutter was appointedAugust 6, 2002 and as a director and Chair of AMAL.AMAL, the managing agent of our Lloyd’s Syndicate 4711, since February 28, 2008. She has served as Chief Executive Officer of Black Diamond Group, LLC since 2001 and Manager of Black Diamond Capital Partners since 2005. Ms. Hutter began her career in 1979 with Swiss Reinsurance Company in New York where she specialized in the then new field of finite reinsurance. From 1993 to 1995, she was Project Director for the Equitas Project at Lloyd’s which became the largest run-off reinsurer in the world. From 1996 to 1999, she served as Chief Executive Officer of Swiss Re America and was a member of the Executive Board of Swiss Re in Zurich. She wasMs. Hutter is director of Shenandoah Life Insurance Company, a director of SBLI USA Life Insurance Company, Inc. and a director and Chair of the Audit Committee of Prosperity Life Insurance Group LLC (Shenandoah’s and SBLI’s holding company). Ms. Hutter previously served as a director and Chair of the audit committee of AmeriLife Group LLC and as a director of Aquila, Inc., Smart Insurance Company (formerly United Prosperity Life Insurance Company) and Talbot Underwriting and related corporate entities. Ms. Hutter currently serves as a director and Chairman of the Audit Committee of AmeriLife Group LLC and Shenandoah Life Insurance Company. Ms. Hutter is a qualified actuary with over

3035 years of experience within the re/insurance industry. Ms. Hutter is a recognized industry leader with relevant experience both in the

U.S.United States and internationally. Ms. Hutter has particular

insurance experience

of insurance at Lloyd’s

havingas she served as Project Director for the Equitas Project at Lloyd’s from 1993 to 1995, and having previously served on the

Boardboard of Talbot Underwriting Ltd. (corporate member and managing agent of Lloyd’s syndicate) from 2002 to 2007. As a result of her experience, Ms. Hutter provides the Board with insight on numerous matters relevant to insurance practice. Ms. Hutter also serves as Chair of

AMAL, the

managing agency of our Lloyd’s Syndicate 4711Risk Committee and as

Chaira member of

our Risk Committee.the Audit and Corporate Governance and Nominating Committees.

Gordon Ireland. Mr. Ireland has been a director of the Company since February 7, 2013. He worked at PricewaterhouseCoopers and its predecessor firms for 36 years until 2010 where he was for nine years a member of the U.K. Firms’ Supervisory Board for nine years, serving at various times as Chairman of the Senior Management Remuneration10

Committee and deputyDeputy Chairman of the Supervisory Board

and was, for a number of years, Chairman of the PricewaterhouseCoopers’ partner admissions panel. Mr. Ireland was Chairman of the PricewaterhouseCoopers’ Global International Insurance Accounting Group. Mr. Ireland

also represented PricewaterhouseCoopers on The Institute of Chartered Accountants in England and Wales (“ICAEW”) Accounting sub-Committee. Mr. Ireland has also represented the ICAEW on the Federation des Experts Comptables European equivalent committee and was a member of the European Financial Reporting Advisory Group Financial Instruments Working Group.

Since July 2010,As of May 27, 2015, Mr. Ireland has been

Directora director of Iccaria Insurance ICC Ltd, a subsidiary of Arthur J. Gallagher & Co. that focuses on longevity swaps for pension funds. Mr. Ireland has also been a director of Yorkshire Building Society Group since September 2015. Mr. Ireland served as a director of Global Insurance Company Limited between March 2011 and December 2014. From July 2010 until June 2015, Mr. Ireland was a director of L&F Holdings Limited and Chief Executive of L&F Indemnity Limited, the professional indemnity captive insurance group which serves the PricewaterhouseCoopers network.

He also served as a director of Lifeguard Insurance (Dublin) Limited, Catamount Indemnity Limited and Professional Asset Indemnity Limited from July 2010 to June 2015.

Mr. Ireland has over 35 years of experience within the financial services sector having worked at PricewaterhouseCoopers. As a result of his audit-led exposure to the London Market and general insurance and reinsurance markets throughout his career, Mr. Ireland provides strong insurance audit skills and technical accountancy expertise to our Board.

As a result, he serves as Chair of the Audit Committee, on which he is also a designated financial expert, and as a member of the Risk Committee.

Karl Mayr. Mr. Mayr has been a director of the Company since December 2, 2015. Mr. Mayr has also served as a director of Aspen U.K. and a member of its Risk Committee since June 2015. Mr. Mayr has served as a Director of Würzburger Versicherungs-AG since 2004. Mr. Mayr worked at Axis Re Europe and Axis Reinsurance from 2003 to 2014 where his most recent roles were as Vice Chairman of Axis Reinsurance and President and Chief Executive Officer of Axis Re Europe. Prior to this, Mr. Mayr was at GE Frankona Reinsurance Company.

Mr. Mayr has over 30 years of experience in the reinsurance sector, primarily in Europe, across a number of product lines in both an underwriting capacity and in managerial roles. As a result of his experience, Mr. Mayr also serves as a member of the Risk Committee.

Peter O’Flinn. Mr. O’Flinn has been a director of the Company since April 29, 2009.2009 and a director of Aspen Bermuda since February 16, 2010. From 1999 to 2003, Mr. O’Flinn was Co-Chairman of LeBoeuf, Lamb, Greene & MacRae. He currently servespreviously served as a director and audit committee member of Sun Life Insurance and Annuity Company of New York from 1998 until August 2013, and of Euler ACI Holdings, Inc. From 1999 to 2003, Mr. O’Flinn was Co-Chair of LeBoeuf, Lamb, Greene and MacRae.from 1998 until December 2013. Mr. O’Flinn is a qualified lawyer with over 25 years of private practice experience. Mr. O’Flinn is a corporate lawyer and former Co-Chairman of LeBoeuf, Lamb, Greene & MacRae, as well as former

Chairchair of their

Corporate Practicecorporate practice, and has extensive experience on legal matters relevant to both the re/insurance industry and public company legal matters generally. Mr. O’Flinn provides the Board with input on corporate initiatives

and regulatory and governance matters. As a result of his experience, Mr. O’Flinn serves as the Chair of

ourthe Corporate Governance and Nominating

Committee and as a member of the Audit Committee.

Bret Pearlman. Mr. Pearlman has been a director of the Company since July 24, 2013. Since 2004, Mr. Pearlman has been a Managing Director of Elevation Partners, where he is also a Co-Founder. In October 2014, Mr. Pearlman also became a Manager of HRS 1776 Partners. Previously, Mr. Pearlman worked for The Blackstone Group where he served as a Senior Managing Director from 2000 to 2004 and held various roles from 1989 to 2000. Mr. Pearlman was a board member of Forbes Media LLC from 2009 to 2014. He joined the board of CHM Holdings LLC in 2015. Mr. Pearlman continues to serve on the board of the Youth Renewal Fund Charity and the Jericho Athletic Association charity.

Mr. Pearlman has over 25 years of experience within private equity, providing a strong understanding of performance management, business models, corporate finance and capital management. His current role as Managing Director at Elevation Partners provides significant experience of the digital world and technology. As a result of his experience, Mr. Pearlman also serves as a member of the Compensation and Investment Committees.

Ronald Pressman. Mr. Pressman was appointed to our Board onhas been a director of the Company since November 17, 2011. Effective January 30, 2012, Mr. Pressman was appointed as Executive Vice President and Chief Executive Officer of TIAA Institutional Financial Services in September 2015, having previously served as Chief Operating Officer of TIAA-CREF.TIAA from January 2012 until September 2015. Previously, he worked at General Electric (GE)(“GE”) Corporation for 31 years, where he was most recently President and Chief Executive Officer of GE Capital Real Estate from 2007 until 2011. From 2000 to 2007, Mr. Pressman also served as President and Chief Executive Officer of GE Asset Management and as Chairman, and Chief Executive Officer and President of Employers Reinsurance. Earlier in his career, Mr. Pressman led GE’sGE energy businesses in Europe, the Middle East, Africa, Southwest Asia and the United States. Mr. Pressman previously served as a member of the board of New York Life Insurance Company.Company from November 2011 until January 2012. He currently serves as Chairman of the national board of A Better Chance, a non-profit organization which provides leadership development opportunities for children of color in the United States. He is also a director of Pathways to College, a non-profit organization that prepares young people from deprived communities for college. Mr. Pressman is also a charter trustee of Hamilton College.

Mr. Pressman has over 30 years of experience within the financial services sector, in particular real estate, asset management and reinsurance, having worked at GE for over 30 years and

currently servingserved as Chief Operating Officer of

TIAA-CREF.TIAA until his appointment as Executive Vice President and Chief Executive Officer of TIAA Institutional Financial Services in September 2015. With his varied experience across such sectors

and having held senior positions, Mr. Pressman provides further insight on a wide-range of matters including

operations, insurance industry and investment management expertise.

As a result of his experience, Mr. Pressman also serves as Chair of the Compensation Committee and as a member of the Investment Committee.

Review and Approval of Transactions with Related

TransactionsPersons

The review and approval of any direct or indirect transactions between

Aspenthe Company and

related persons“related persons” (directors, executive officers or any of their immediate family members) is governed by

the Company’sour Code of

Business Conduct

and Ethics, which provides guidelines for any transaction which may create a conflict of interest between us and our employees, officers or directors and members of their immediate family. Pursuant to

theour Code of

Business Conduct

and Ethics, we will review personal benefits received, personal financial interest in a transaction and certain business relationships in evaluating whether a conflict of interest exists. The Audit Committee is responsible for applying the Company’s

conflict of interest policy and approving certain individual transactions.

11

On January 22, 2010, we entered into a sale and purchase agreement to purchase APJ Continuation Limited (“APJ”) and its subsidiaries for an aggregate consideration of $4.8 million. The business writes a specialist book of Kidnap and Ransom (“K&R”) insurance which complements our existing credit, political and terrorism line of business. Mr. Villers, one of our executive officers, was a director of APJ until 2010 and was a 30% shareholder of APJ.

Under the NYSE Corporate Governance Standards applicable to U.S. domestic issuers, a majority of the Board

(andand each member of the Audit, Compensation and

Nominating and Corporate Governance

Committees)and Nominating Committees must be independent. The Board may determine a director to be independent if the director has no disqualifying relationship as enumerated in the NYSE Corporate Governance Standards and if the Board has affirmatively determined that the director has no direct or indirect material relationship with the Company. Independence determinations are made on an annual basis at the time the Board approves director nominees for inclusion in the annual proxy statement and

ifon an ad hoc basis when a director joins the Board between annual

meetings, at such time.general meetings.

The Board reviews various transactions, relationships and arrangements of individual directors in determining whether they are independent. The Board considered Mr. Ahamed’s position as

(i) advisor to the Rock Creek Group,

and as(ii) director of

the Rohatyn Group and

related series of funds, (iii) member of the

Board of Trustees of Putnam

Funds.Funds, (iv) member of the Board of Trustees of the Brookings Institution and (v) his various roles with non-profit organizations. With respect to Mr. Beer, the Board considered his position as

chair of the Actuarial Standards Board and as vice-chair, and chair of the compensation committee,(i) director of United Educators Insurance Company,

as well as his position as(ii) professor at St. John’s

University.University School of Risk Management, (iii) member of the Board of the American Academy of Actuaries and (iv) trustee emeritus for the Actuarial Foundation. With respect to Mr. Bucknall, the Board considered his position as

non-executive director(i) chairman, and member of

the audit and risk committees, of Tokio Marine Kiln Insurance Limited (formerly Tokio Marine Europe Insurance

Limited), (ii) non-executive chairman of FIM Services Limited,

as well as his roles within(iii) non-executive chairman, and audit committee member, of the XIS

Group.Group (Ins-Sure Holdings Limited, Ins-Sure Services Limited, London Processing Centre Ltd and LSPO Limited) and (iv) a fellow of the Chartered Insurance Institute. The Board considered Mr. Cavoores’ position as chairman of Guidewire Software, Inc. and as a director of Cunningham Lindsey Inc. With respect to Mr.

Cormack,Gregg, the Board considered his

position as non-executive director of Phoenix Group Holdings Ltd. (formerly Pearl Group Ltd.), Phoenix Life Holdings Ltd, Bloomsbury Publishing Plc, National Angels Ltd, Arria LNG Ltd. and Xchanging plc. The Board also considered Mr. Cormack’s positions as chair of Entertaining Finance Ltd. and Maven Income and Growth VCT 4 plc.various roles with non-profit organizations. With respect to Ms. Hutter, the Board considered her

positionpositions as

(i) non-executive director,

and audit committee chair, of AmeriLife Group LLC,

Smart Insurance Company (formerly United Prosperity Life Insurance Company)(ii) non-executive director, and

audit committee chair, of Shenandoah Life Insurance

Company. The Board also considered Ms. Hutter’s position as Chief Executive OfficerCompany, (iii) chief executive officer of Black Diamond Group LLC,

as(iv) manager of Black Diamond Capital Partners,

(v) director of Prosperity Life Insurance Group, LLC, (vi) director of SBLI USA Life Insurance Company, Inc. and

as(vii) member of the Board of Overseers for St. John’s University. With

regardsrespect to Mr. Ireland, the Board considered his position as (i) director of Iccaria Insurance ICC Ltd and (ii) director of Yorkshire Building Society Group. With respect to Mr. Mayr, the Board considered his position as director of Würzburger Versicherungs - AG. With respect to Mr. O’Flinn, the Board considered his

role as non-executive director of Sun Life Insurance and Annuity Company and Euler ACI Holdings, Inc. The Board consideredvarious roles with non-profit organizations. With respect to Mr.

Pressman’s role as Chief Operating Officer of TIAA-CREF. In addition,Pearlman, the Board considered

Mr. Ireland’shis position as

Chief Executive(i) managing director of Elevation Partners, (ii) manager of HRS 1776 Partners, (iii) director of CHM Holdings LLC and

Director(iv) his various roles with non-profit organizations. With respect to Mr. Pressman, the Board considered his role as executive vice president and chief executive officer of

L&F Holdings Limited, the professional indemnity captive insurance company which serves the PricewaterhouseCoopers network.TIAA Institutional Financial Services and his various roles with non-profit organizations.

The Board

has made the determination that Messrs. Ahamed, Beer, Bucknall,

Cormack,Cavoores, Gregg, Ireland,

Mayr, O’Flinn,

Pearlman and Pressman and Ms. Hutter are independent and have no material relationships with the Company.

As stated above, the NYSE Corporate Governance Standards require that all members of the Audit, Compensation and Corporate Governance and Nominating Committees must be independent. The Board

has determined that,

and as of the

date of this Proxy Statement, the Company’s Audit,

Committee isCompensation and Corporate Governance and Nominating Committees are comprised entirely of independent directors in accordance with the NYSE Corporate Governance Standards.

The NYSE Corporate Governance Standards require that all members of compensation committees and nominating and corporate governance committees be independent. As of the date of this report, all members of the Compensation Committee and all members of the Corporate Governance and Nominating Committee are independent. Committees of the Board of Directors

As of February 15, 2016, we had the following committees of the Board: Audit Committee: Messrs. Cormack,Ireland, Beer, Bucknall, Ireland,Gregg, O’Flinn and Ms. Hutter. The Audit Committee has general responsibility for the oversight and supervision of our accounting, reporting and financial control practices. TheAmong other things, the Audit Committee annually reviews the qualifications of the independent auditors, makes recommendations to the Board as to their

selection and reviews the plan, fees and results of their audit. Mr.

CormackIreland is

the Chairman of the Audit Committee.

The Board determined that Messrs. Beer and Ireland each qualify as an “audit committee financial expert” pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”). The Audit Committee held four meetings during

2012. The Board considers Mr. Beer to be an “audit committee financial expert” as defined in the applicable regulations. Effective February 7, 2013, Mr. Ireland was appointed to the Audit Committee.12

2015.

Compensation Committee: Messrs. Bucknall, Beer, CormackGregg, Pearlman and Pressman. The Compensation Committee oversees our compensation and benefit policies and programs, including administration of our annual bonus awardspool funding and long-term incentive plans. ItAmong other things, the Compensation Committee determines the compensation of the Chief Executive Officer, executive directors and key employees. Mr. BucknallPressman is the Chairman of the Compensation Committee. The Compensation Committee held fourfive meetings during 2012.2015. Investment Committee: Messrs. Ahamed, Jones, CusackPearlman and Pressman. The Investment Committee is an advisory committee to the Board which, among other things, formulates our investment policy and oversees all of our significant investing activities. Mr. Ahamed is the Chairman of the Investment Committee. The Investment Committee held four meetings during 2012.2015. Corporate Governance and Nominating Committee: Messrs. BucknallO’ Flinn and O’FlinnBucknall and Ms. Hutter. The Corporate Governance and Nominating Committee establishes, among other things, establishes the Board’s criteria for selecting new directors and oversees the evaluation of the Board and management.Board. Mr. O’Flinn is the Chairman of the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee held four meetings during 2012.2015. Risk Committee: Ms. Hutter, Messrs. Ahamed, Beer, Bucknall, Cavoores, CormackGregg, Ireland and Cusack. TheMayr. Among other things, the Risk Committee’s responsibilities include the establishment ofCommittee is responsible for establishing our risk management strategy, approval ofapproving our risk management framework, methodologies and policies, and review ofreviewing our approach for determining and measuring our risk tolerances. Ms. Hutter is the Chair of the Risk Committee. The Risk Committee held fourfive meetings during 2012.2015.The

In addition, the Board may,

also, from time to time, implement ad hoc committees for specific purposes.

No ad hoc committees were established or held during 2015.

Compensation Committee Interlocks and Insider Participation

During the year ended December 31, 2015, no member of the Compensation Committee served as an officer or employee of the Company or any of its subsidiaries and none of our executive officers served as a member of the Compensation Committee or as a director of another entity, one of whose executive officers served on our Compensation Committee or as one of our directors.

We have separate Chief Executive Officer and Chairman positions in the Company.

We believe that while theThe Chief Executive Officer is responsible for the day-to-day management of the

Company, theCompany. The Chairman, who is not an employee of the Company

and who is notor part of the Company’s management, provides the appropriate leadership role for the Board and is able to effectively facilitate the contribution of non-executive directors and constructive interaction between management (including executive directors) and the non-executive directors in assessing the Company’s performance, strategies and means of achieving them. As part of his leadership role, the Chairman is responsible for the Board’s effectiveness and sets the Board’s agenda in conjunction with the Chief Executive Officer.

Under the scope of his role as Chairman, Mr. Jones is more involved in the management of the Company than an independent director would be under U.S. practice and rules; however, his role and compensation under practices in other jurisdictions, such as

in the

U.K.United Kingdom, would not compromise his independence. The more specific chairman duties identified in

hisMr. Jones’ appointment letter result in greater time allocated for the operations of the Company than the other non-executive directors.

In addition, under the scope of her role as the Company’s Lead Independent Director, Ms. Hutter has the following additional responsibilities:

•coordinating and moderating executive sessions of the Board’s independent directors not less than once annually;

•working closely with the Chairman and providing support in relation to the Board’s operations and governance processes;

•acting as the principal liaison between the independent directors and the Chairman and the Chief Executive Officer;

monitoring, in conjunction with the Chairman, the process by which Board agendas are set to ensure the quality, quantity and timeliness of the flow of information from management that is necessary for the independent directors to perform their duties effectively and responsibly;

•being available to the shareholders to address any concerns or issues; and

performing such other duties as the Board may from time to time delegate to the Lead Independent Director to assist the Board in the fulfillment of its responsibilities.

Role in Risk Oversight

Risk Governance.In this section, we provide a summary of our Risk Governancerisk governance arrangements and our current Risk Management Strategy.risk management strategy. We also provide more detail on the management of core underwriting and market risks and on our Internal Model.internal model. The Internal Modelinternal model is an economic capital model which has been developed internally for use in certain business decision makingdecision-making processes, the assessment of risk basedrisk-based capital requirements and for various regulatory purposes.

Risk GovernanceBoard of Directors. The Board considers effective identification, measurement, monitoring, management and reporting of the risks facing our business to be key elements of its responsibilities and those of the Group

13

Chief Executive Officer and management. Matters relating to risk management that are reserved to the Board include approval of the internal controls and risk management framework and any changes to the Group’s risk appetite statement.statement and key risk limits. The Board also receives reports at each scheduled meeting from the Group Chief Risk Officer and the Chairman of the Risk Committee andas well as training in risk management processes including the design, operation, use and limitations of the Internal Model.internal model. As a result of these arrangements and processes, the Board, assisted by management and itsthe Board Committees, is able to exercise effective oversight of the operation of the risk management strategy described in “Risk Management Strategy” below.

Board Committees. The Board delegates oversight of the management of certain key risks to its Risk, Audit and Investment Committees. Each of the committees is chaired by an independent director of the Company who also reports to the Board on the committees’ discussions and matters arising. Risk Committee: The purpose of this committee is to assist the Board in its oversight duties in respect of the management of risk, including: making recommendations to the Board regarding management’s proposals for the risk management framework, risk appetite, key risk limits and the use of our Internal Model;

internal model;monitoring compliance with the agreed Group risk appetite and key risk limits; and

oversight of the process of stress and scenario testing established by management.

Audit Committee: This committee is primarily responsible for assisting the Board in its oversight of the integrity of the financial statements. It is also responsible for reviewing the adequacy and effectiveness of the Company’s internal controls and receives regular reports from both internal and external audit in this regard. Investment Committee: This committee is primarily responsible for among other things, setting and monitoring the Group’s investment risk and asset allocation policies and ensuring that the Chairman of the Risk Committee is kept informed of such matters. Management Committees. The groupGroup also has a number of executive management committees which have oversight of certain risk management processes.processes including the following: Group Executive Committee: This is the main executive committee responsible for advising the Group Chief Executive Officer on matters relating to the strategy and conduct of the business of the Group.Group’s business. Capital Allocation Group:and Risk Principles Committee: The primary purpose of the Capital Allocation Groupand Risk Principles Committee is to assist the Group Chief Executive Officer and the Group Chief Risk Officer in their oversight duties in respect of the design and operation of the Group’s risk management systems of the Aspen Group.systems. In particular, it has specific responsibilities in relation to the Internal Modelinternal model and for the establishment of risk limits for accumulating insurance exposures.underwriting exposures and monitoring solvency and liquidity requirements. Reserve Committee: This committee is responsible for managing reserving risk and making recommendations to executive managementthe Group Chief Executive Officer and the Group Chief Financial Officer relating to the appropriate level of reserves to include in the Group’s financial statements. Underwriting Committee: The purpose of this committee is to assist the Group Chief Executive Officer in his oversight duties in respect of the management and control of underwriting risk, including oversight of the independent review of the quality of each team’s underwriting. Reinsurance Credit Committee: The purpose of this committee is to seek to minimize credit risks arising from insurance and reinsurance counterparties by the assessment and monitoring of collateralized reinsurance arrangements, direct cedants, intermediaries and reinsurers. Group Chief Risk Officer. Our Group Chief Risk Officer, Stephen Postlewhite,Richard Thornton, is a member of the Group Executive Committee. His role includes providing the Board and the Risk Committee with reports and advice on risk management issues.14

We operate an integrated

enterprise-wide risk management strategy designed to deliver shareholder value in a sustainable

and efficient manner while providing a high level of policyholder protection. The execution of our integrated risk management strategy is based on:

the establishment and maintenance of a risk management and internal control system based on a three lines of defense approach to the allocation of responsibilities between risk accepting units (first line), risk management activity and oversight from other central control functions (second line) and independent assurance (third line);

identifying material risks to the achievement of the Group’s objectives including emerging risks;

the articulation at Group level of our risk appetite and a consistent set of key risk limits for each material component of risk;

the cascading of key risk limits for material risks to each operating subsidiary and, where appropriate, risk accepting business units;

measurement,measuring, monitoring, managing and reporting of risk positions and trends;

the use, subject to an understanding of its limitations, of the Internal Modelinternal model to test strategic and tactical business decisions and to assess compliance with the Risk Appetite Statement;risk appetite statement; and

stress and scenario testing, including reverse stress testing, designed to help us better understand and develop contingency plans for the likely effects of extreme events or combinations of events on capital adequacy and liquidity.

Risk Appetite Statement. The Risk Appetite Statementrisk appetite statement is a central component of the Group’s overall risk management framework and is approved by the Board. It sets out, at a high level, how we think about risk in the context of our business model, groupGroup objectives and strategy. It sets out boundary conditions and limits for the level of risk we assume, together with a statement of whatthe reward we aim to receive for this level of risk.It

Our risk appetite statement comprises the following components:

| • | | Risk preferences: a high level description of the types of risks we prefer to assume and those we prefer to minimize or avoid; Return objective: the levels of return on capital we seek to achieve, subject to our risk constraints; Volatility constraint: a target limit on earnings volatility; and Capital constraint: a minimum level of risk adjusted capital. Risk preferences: a high level description of the types of risks we prefer to assume and to avoid;

|

| • | | Return objective: the levels of return on capital we seek to achieve, subject to our risk constraints;

|

| • | | Volatility constraint: a target limit on earnings volatility; and

|

| • | | Capital constraint: a minimum level of risk adjusted capital.

|

Risk Components. The main types of risks that we face are:are summarized as follows: